Back

Legislation updates affecting Bermuda Companies

30 April 2018

Bermuda

Increase of Government Fees

The Bermuda Government recently passed the Companies and Partnership (Fees) Act 2018 (the Act) which increases certain fees charged under the Companies Act 1981, the Limited Partnership Act 1992, and the Overseas Partnership Act 1995.

The Act came into effect on 1 April 2018 and this update specifically relates to the fees chargeable to standard exempted companies (not conducting insurance, investment or mutual fund business).

Exempted Companies

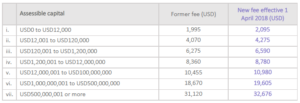

The annual Government fee is charged on a graduated scale according to the assessible capital (authorised capital plus any share premium account) as per the table below showing the old and new fees:

Marbury’s affected clients will be notified in advance of their annual billing cycle.

Beneficial Ownership Register

New legislation was enacted on 23 March 2018 with the purpose of enabling Bermuda to meet international standards with respect to the accessibility of beneficial ownership information. Unless exempted from the legislation, Bermuda entities have six months to comply with the new requirements.

The new legislation essentially codifies existing practice and requires all Bermuda incorporated companies, limited liability companies (LLCs), partnerships and limited partnerships (unless exempted under the legislation) to file a register of beneficial ownership information (and any amendments to such register) with the Bermuda Monetary Authority (BMA).

The beneficial ownership register will not be public, but must be filed with the BMA and kept at the registered office of the Bermuda entity or at such other place in Bermuda convenient for inspection by the Registrar of Companies.

Bermuda has identified and vetted beneficial owners of corporate and legal entities for over 70 years, including at the time of formation and on an ongoing basis for exchange control purposes. The information to be included in the beneficial ownership register is in line with the BMA’s historical requirements for Bermuda corporate entities to maintain and provide to the BMA, and as such the new legislation does not greatly change the process of incorporation implemented by Marbury.

For all existing Bermuda entities, it is important to assess whether the new legislation is applicable or if an exemption applies. Marbury will contact affected Bermuda clients to confirm their next steps as appropriate.

For more information on any aspect of this briefing please contact us via your usual Marbury advisor or info@marburys.com.